In average message cost

In message deliverability

Better customer connections keep business healthy

Introduction

Owned and operated by the Lac Courte Oreilles tribe, LCO Financial Services is a consumer lender that prioritizes sovereign lending. Staying connected with current and former customers is essential to this mission, so LCO Financial Services has always strived to run effective messaging campaigns.

The Challenge

Unfortunately, LCO Financial Services discovered that the texts they sent with a previous SMS provider were failing to send—more than half of their SMS messages for certain campaigns. Some of the issues stemmed from major carriers miscategorizing their messages and then blocking them. On top of that, the generic-looking 10-digit long codes used by LCO Financial Services also led some customers to ignore the messages that did get past the carriers’ filters. When they tried to get support from their provider, they were left empty-handed.

LCO Financial Services needed a way to ensure their messages were received and build trust with customers through those messages.

“There’s plenty of focus and energy put forth by businesses to be able to fully identify their own customers,” says Eric Reamer, COO of LCO Financial Services. “But I think it’s equally important for your customers to be able to identify their service providers, to be sure that they’re actually communicating with their lender, and not a bad actor.”

The Solution

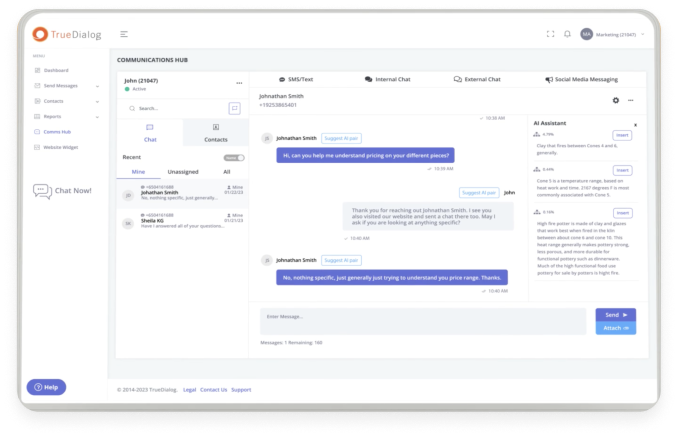

Carrier regulatory compliance is paramount for any modern business using SMS, but it’s extra important for LCO Financial Services because they’re already operating in a financial space with many other regulatory pressures. They chose TrueDialog for the robust platform and the outstanding customer success, which helps them stay compliant.

To build brand trust, TrueDialog helped LCO Financial Services secure a dedicated short code for their messaging. These five- or six-digit numbers improve deliverability with carriers and are easily identifiable by their customers.

LCO Financial Services is also using the TrueDelivery feature, an AI-powered text message deliverability scoring tool which analyzes their message content and scores the likelihood of it being caught in the carrier’s spam filter before sending it out.

This comprehensive approach has been easy for LCO Financial Services’ teams to implement. “Once we provisioned our short code, we were off to the races to figure out every juncture within our customer lifecycle,” says Reamer. “We can improve the quality of our communications and have many different options for how we can interact and utilize TrueDialog’s services.”

“The integration process with TrueDialog has been seamless. Their vast API library is intuitive—we had no issue translating the needed services. And when our dev team has questions, they’ve worked well with the support team at TrueDialog. It’s really been a top-notch partnership.”

– Eric Reamer, COO

The Result

Prior to partnering with TrueDialog, the average cost for each of LCO Financial Services’ messages sent was 3.9 cents, and their deliverability rates for some campaigns dipped as low as 60%!

The average cost today is approximately one cent per message, representing a 75% reduction. Additionally, they’re experiencing a 100% improvement in deliverability. More messages delivered at a fraction of the cost means better campaign outcomes and improved business efficiency.

“Establishing a short code identity fosters our ongoing communication with our current and also our former customers,” explains Reamer. “TrueDialog allows us to deliver content-rich messages, including MMS. And even emojis, which are becoming so popular these days. The platform helps us maintain full deliverability and engage in direct two-way communications with our customers.”

Achieving reliable message delivery has nurtured more customer trust, contributing significantly to the growth and success of LCO Financial Services. After rapid expansion over the past several years, they now have the messaging infrastructure in place to continue scaling and keep that trend line climbing.